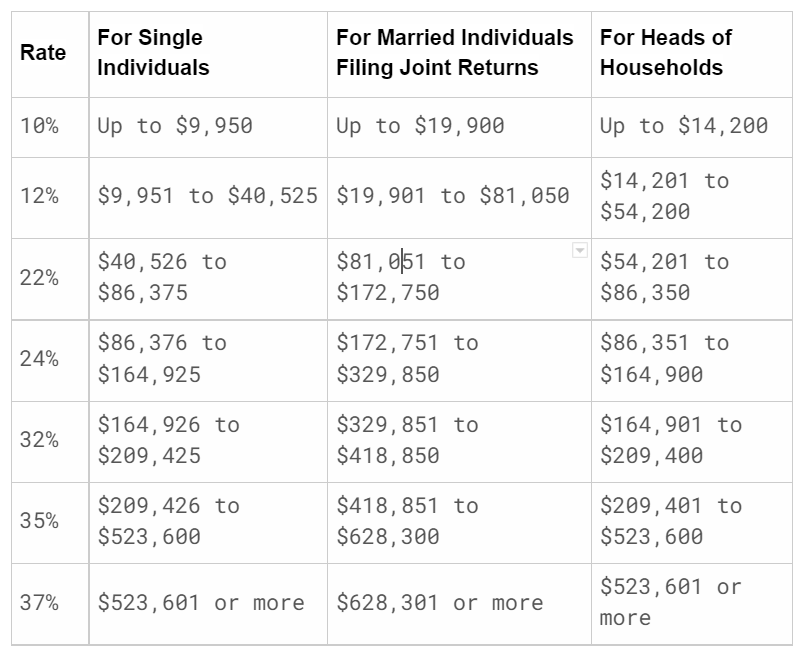

Tax Brackets 2025 Married Jointly Irs. You can view the tax rates for all incomes and filing statues here: How many tax brackets are there?

For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing jointly.

The Top Marginal Income Tax Rate Of 37 Percent Will Hit Taxpayers With Taxable Income Above $609,350 For Single Filers And Above $731,200 For Married Couples Filing Jointly.

Use tab to go to the next focusable element.

Irs Announces 2025 Tax Brackets, Updated Standard Deduction.

Here’s how that works for a single person earning $58,000 per year:

2025 Tax Rates For Other Filers.

Images References :

Source: www.aarp.org

Source: www.aarp.org

IRS Sets 2025 Tax Brackets with Inflation Adjustments, 35% for incomes over $243,725 or $487,450 for married couples filing jointly. In 2025, the excess taxable income above which the 28% tax rate applies will likely be $116,300 for married taxpayers filing separate returns.

Source: margarethendren.pages.dev

Source: margarethendren.pages.dev

Irs Tax Brackets 2025 Jemmy Verine, Note that tax brackets for heads of households have also been adjusted by the irs. Use tab to go to the next focusable element.

Source: rgwealth.com

Source: rgwealth.com

2025 Tax Code Changes Everything You Need To Know RGWM Insights, Your bracket depends on your taxable income and filing status. The lower your taxable income is, the lower your tax bill.

Source: nicholasbrown.pages.dev

Source: nicholasbrown.pages.dev

2025 Tax Brackets Married Jointly Single Cherye Juliann, Your bracket depends on your taxable income and filing status. The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

2025 California Tax Brackets Married Filing Jointly Amalea Blondell, Here’s how that works for a single person earning $58,000 per year: For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Source: maxwelllandreth.pages.dev

Source: maxwelllandreth.pages.dev

2025 Irs Tax Brackets Married Filing Jointly Cammi Rhiamon, The 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year. For 2025, the irs made adjustments to federal income tax brackets to account for.

Source: joshuahutton.pages.dev

Source: joshuahutton.pages.dev

Tax Brackets 2025 Married Jointly Chart Linea Petunia, For 2025, the irs made adjustments to federal income tax brackets to account for. For 2025 (tax returns typically filed in april 2025), the standard deduction.

Source: nataliejones.pages.dev

Source: nataliejones.pages.dev

What Is The Tax Bracket For 2025 Married Belita Chloris, How many tax brackets are there? For 2025, the irs made adjustments to federal income tax brackets to account for.

Source: ednafletcher.pages.dev

Source: ednafletcher.pages.dev

Tax Brackets 2025 Chart Irs Kare Sharon, The standard deduction for single taxpayers. In 2025, the excess taxable income above which the 28% tax rate applies will likely be $116,300 for married taxpayers filing separate returns.

Source: teletype.in

Source: teletype.in

Tax brackets married filing jointly — Teletype, The standard deduction for single taxpayers. The seven federal income tax brackets for 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The Seven Federal Income Tax Brackets For 2025 Are 10%, 12%, 22%, 24%, 32%, 35% And 37%.

The standard deduction is the fixed amount the irs allows you to deduct from your annual income even if you don’t itemize your tax return.

35% For Incomes Over $243,725 ($487,450 For Married Couples Filing Jointly) 32% For Incomes Over $191,950 ($383,900 For Married Couples Filing Jointly)

37% for individual single taxpayers with incomes greater than $609,350 or $731,200 for married couples filing jointly.